Introduction

Understanding Bad Credit Loans

Bad credit loans are designed to assist individuals with less-than-perfect credit scores in accessing necessary funds. These loans can be crucial in times of financial need, providing a means to cover unexpected expenses, consolidate debt, or make essential investments. At Badger Loans, we specialise in connecting borrowers with a network of over 30 UK, FCA authorised lenders, ensuring that even those with adverse credit can find suitable financial solutions.

Why Choose Badger Loans?

Badger Loans offers a straightforward application process, competitive interest rates, and a focus on finding the right loan for your circumstances. Our pingtree platform quickly matches your requirements with appropriate lenders, often delivering a decision within minutes and disbursing funds within 1-2 days.

Types of Bad Credit Loans

Personal Loans for Bad Credit

These loans offer a more traditional borrowing option, providing flexibility in terms of loan amounts and repayment periods. They are suitable for larger financial needs or debt consolidation.

Payday Loans for Bad Credit

Payday loans are short term solutions designed for quick access to cash, typically repaid on your next payday. They are ideal for covering immediate expenses like emergency repairs or unexpected bills.

Short Term Loans for Bad Credit

Short term loans offer slightly longer repayment periods compared to payday loans, providing more flexibility in managing your repayments.

Specific Uses of Bad Credit Loans

Emergency Expenses

Bad credit payday loans are particularly useful for urgent financial needs that cannot wait until your next payday. This could include unforeseen bills or necessary repairs.

Debt Consolidation

Consolidating multiple high-interest debts into a single loan with a lower interest rate can simplify your finances and reduce overall costs.

Application Process

Eligibility Criteria

Eligibility typically includes being employed, having a regular income, and demonstrating the ability to make timely repayments. Even with poor credit, showing financial stability can improve your chances of approval.

How to Apply

- Start Your Application: Click here to begin your application on Badger Loans.

- Provide Necessary Information: This includes personal details, income, and banking information.

- Receive a Decision: Often within minutes, with funds potentially available the same day.

Understanding Loan Terms

Loan Amounts and Repayment Periods

Loan amounts can range from smaller sums for payday loans to larger amounts up to £25,000 for personal loans. Repayment periods can vary from one month to five years.

Interest Rates and Fees

Interest rates depend on your credit score and the loan amount. It’s important to note that rates may be higher for those with poor credit as lenders account for the increased risk.

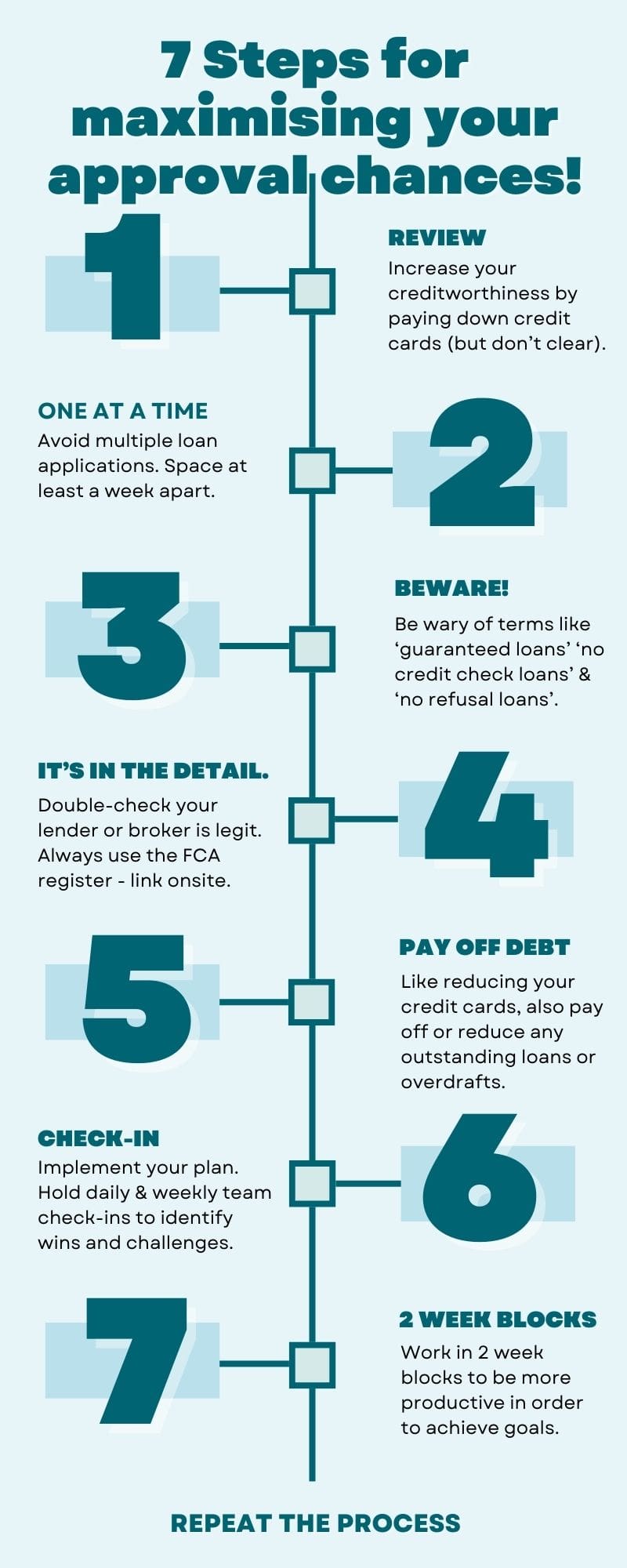

Maximising Your Chances of Approval

Improving Creditworthiness

Steps such as making on-time payments, reducing existing debts, and avoiding multiple loan applications can improve your credit score over time.

Avoiding Pitfalls

Be wary of terms like “no refusal loans” or “no credit check loans.” These can often be misleading and may indicate predatory lending practices. Always verify the legitimacy of the lender.

Using Brokers and Lenders Wisely

Brokers like Badger Loans simplify the process by connecting you with multiple lenders, increasing your chances of finding a suitable loan.

Conclusion

Planning for the Future

After securing a loan, focus on improving your financial habits to avoid future credit issues. Use the loan responsibly to rebuild your credit and aim for better loan terms in the future.

Disclaimer: This guide is for informational purposes only. Always consult with a financial advisor before taking out a loan.